Consumer Fintech Has Plaid. What Does Industrial Finance Have?

Fintech made billions intermediating transactions. Payments, lending, insurance were unbundled, API-enabled and embedded at checkout. That playbook worked because consumer finance is data-rich. The underwriting inputs already existed, and platforms like Plaid built the pipes to access them.

That same playbook breaks in industrial finance. The data here is operational, not just financial, and the pipes don’t exist. Yet capital is pouring in anyway.

Last month, Apollo and 8VC announced a multi-billion-dollar partnership to finance companies in advanced manufacturing, aerospace, energy, life sciences, logistics, and natural resources. They’re targeting businesses with “real assets, long-term contracts, and established operating models.” In practice, this capital is designed for mature companies, which leaves most of the industrial base out.

The data needed to expand access does exist. It’s just trapped across incompatible systems with no common schema, no standardization, and no API for lenders to pull it together. Consumer fintech had Plaid. Industrial finance still has no rails.

But that’s starting to change.

The Thesis

The bottleneck in industrial finance isn't capital - it's infrastructure. Companies that can aggregate fragmented operational data, standardize it for underwriting, and deliver it to lenders will control who gets financed and on what terms.

The wedge is the workflow. The moat is the data. The unlock is the pipe.

Where the Data Lives

Industrial underwriting requires answers to questions that don’t exist in financial statements:

How often does the equipment fail?

What’s the throughput on Line 3 this month versus last year?

How many hours are crews idle due to scheduling gaps?

What’s the defect rate by SKU, shift, or machine?

How predictable is demand and how volatile are inputs?

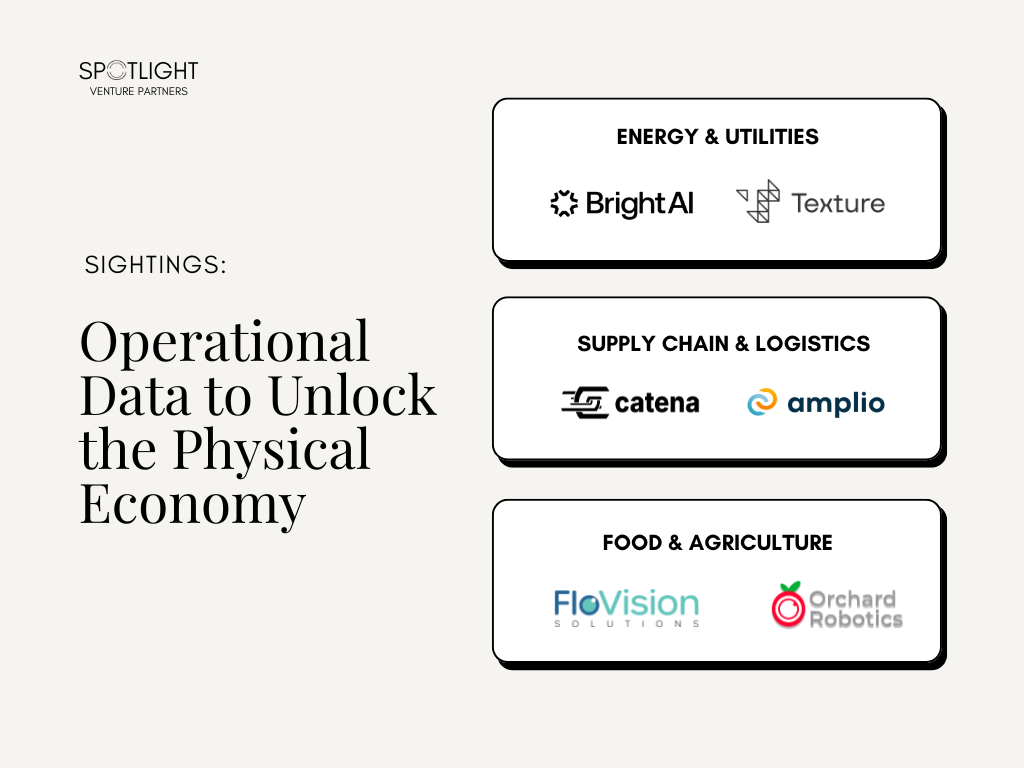

Across industrial categories, a new generation of software companies is capturing this data for the first time.

These companies stand out because they prove what was long assumed impossible: critical operational data can be captured, structured, and standardized at scale.

They’re not fintech or underwriting tools. They’re workflow and operations platforms. But in solving real problems for manufacturers, supply-chain teams, and field operators, they’re generating the exact data that will enable new forms of industrial finance.

Here are six top Seed and Series A companies building this new data infrastructure that will drive the next wave of industrial innovation.

Click any row in the table below to view detailed company profiles.

We’re seeing data plays emerge that didn’t exist even two years ago and entirely new business models forming because of it. If you're a founder building in this space, let's talk.

-Kiswana