WE SURFACE SIGNALS IN THE

BLINDSPOT

This dashboard offers a preview of our fintech intelligence, one layer of the comprehensive market data we track across our core themes.

-

1000+

Companies

-

30+

Data Points

-

50+

Identified Themes

-

4

Global Markets

US Signals

AI is shifting where power and possibility exist in financial services — redefining how risk is measured, who gets served, and how products reach the market. The signals here point to where opportunities are emerging.

AI Lending Moves Beyond Credit Scores

While 90% of U.S. lenders believe alternative data can expand access to credit, only 43% currently use it in underwriting. Innovators like Taktile, Pipe, and Zest AI are leveraging real-time financial data, such as bank transactions and cash flow patterns, to serve SMBs that traditional models overlook.

AI Lending Moves Beyond Credit Scores

The gap between recognition and adoption presents a strategic opportunity. Startups that own the data infrastructure layer—APIs for permissioned bank data, automated cash flow analysis, or limited credit history risk models—can become systemic vendors in a $1.2T market. In a crowded lending space, distribution moats will emerge from proprietary underwriting signals and integrations into vertical platforms.

Vertical SaaS Drives Embedded Finance Distribution

Vertical SaaS platforms like Toast, ServiceTitan, and Mindbody are integrating embedded finance powered by adaptive AI, leveraging real-time operational data to optimize underwriting, fraud detection, compliance, and upsell financing. This enables financial services tailored precisely to industry-specific workflows and business cycles.

Vertical SaaS Drives Embedded Finance Distribution

AI-first startups embedding adaptive intelligence into vertical SaaS are turning real-time operational data into financial leverage. By powering underwriting, pricing, and compliance within industry workflows—and combining this with embedded distribution—they scale faster and more efficiently than standalone fintechs, creating durable moats in sectors where CAC and regulation have typically crushed margins.

AI Enables Adaptive Compliance Workflows

Emerging RegTech startups are leveraging behavioral biometrics for continuous fraud detection, blockchain-based decentralized identity systems for self-sovereign KYC, and synthetic data to train privacy-preserving AI models—enabling more adaptive, compliant, and scalable risk management solutions.

AI Enables Adaptive Compliance Workflows

AI-powered compliance is fast becoming a gatekeeper for enterprise distribution and go-to-market velocity—especially in regulated verticals like lending, insurance, and payroll. Startups that build privacy-native infrastructure with real-time risk detection, user-controlled identity, and explainable AI will unlock new markets and establish defensible moats over legacy tools.

Featured Companies

Startups are already building for the next era of financial services. They’re applying AI in ways that break open legacy constraints and offer a glimpse of what the future could look like — more automated, more adaptive, and more accessible by design.

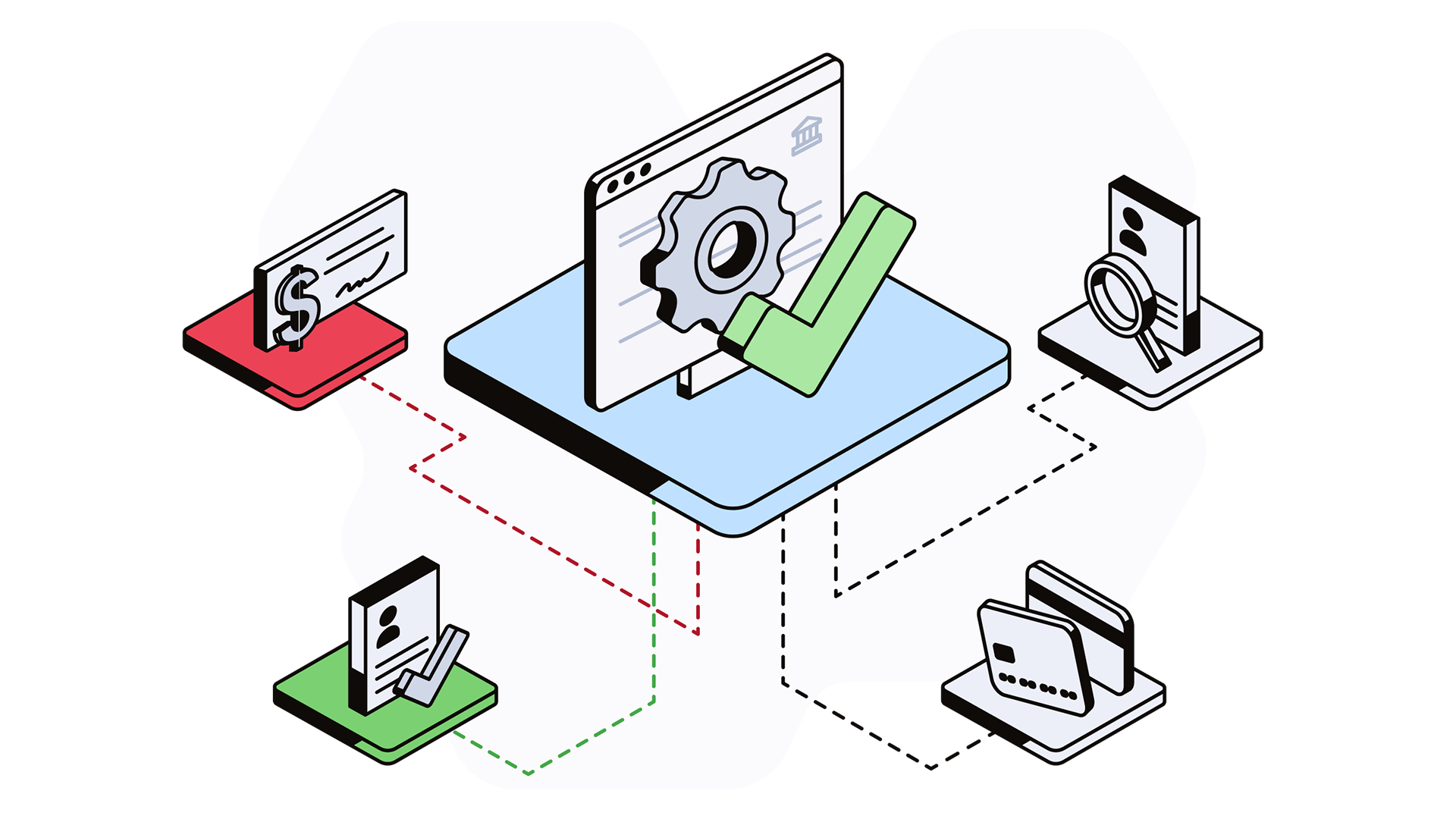

The Stack

Financial services were once siloed. Today, AI is connecting data, decisioning, and delivery into an integrated ecosystem. Here’s our map of how these core layers are evolving to unlock new capabilities and markets.

-

The Foundation Layer

Systems that make critical data like income, employment, cash flow, and identity usable for financial services.

Why it matters:

Access starts with visibility. These platforms turn fragmented or permissioned data into clean, actionable signals that power underwriting, onboarding, and fraud prevention.

-

The Intelligence Layer

Models that assess creditworthiness, fraud risk, and pricing in real time, using alternative and dynamic data.

Why it matters:

Traditional scoring leaves out millions. Adaptive risk models enable more precise and fair lending decisions beyond traditional credit scores.

-

The Delivery Layer

Platforms that embed credit, payments, or insurance into everyday workflows—bringing financial services directly to where users already operate

Why it matters:

Distribution provides an advantage. Embedding financial services within vertical tools reduces friction, lowers customer acquisition costs, and connects directly to users like gig workers and SMBs.

-

The Application Layer:

AI-powered products that help consumers and small businesses manage money, plan ahead, and build financial resilience.

Why it matters:

These tools automate smart decisions for users who lack the time, financial literacy, or resources to navigate traditional systems

-

The Trust Layer

Tools that ensure AI systems are explainable, privacy-conscious, and aligned with evolving regulation.

Why it matters:

Trust is a prerequisite. Financial access at scale depends on AI that regulators, institutions, and users can confidently rely on.

Emerging Market Signals

The most constrained markets give rise to the smartest financial innovations. By examining how AI overcomes these challenges globally, we uncover clues on how financial services can be transformed in the U.S.