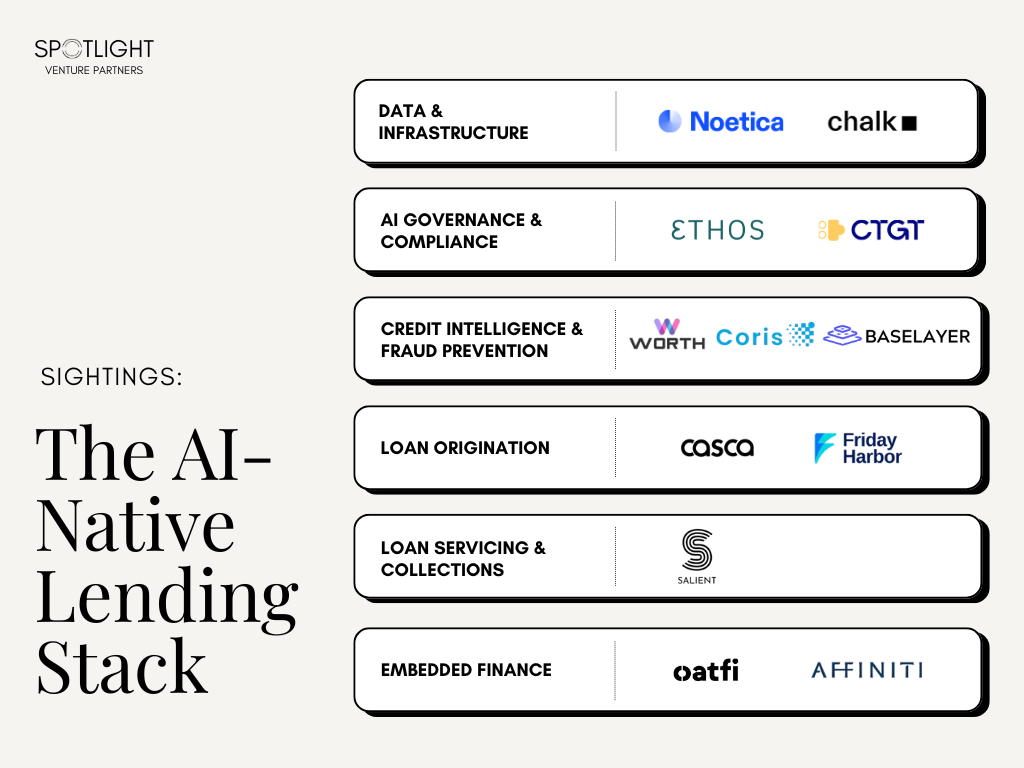

Sightings: The AI-Native Lending Stack

AI is fundamentally reshaping how lenders make credit decisions. Traditional models that relied on credit scores and debt-to-income ratios are evolving into systems capable of analyzing thousands of data points in real time—from spending patterns to IoT data streams.

What's driving this transformation is the convergence of rapidly advancing AI capabilities and urgent market pressures. Between 2025 and 2029, about $6.3 trillion in U.S. corporate bonds—much of it issued during the low-rate era—will mature, forcing companies to refinance at significantly higher interest rates. This refinancing pressure creates cascading effects. When a company refinances $100M of debt from 2% to 6% rates, annual interest payments triple from $2M to $6M, creating a $4M hit to operating income that can trigger covenant breaches and credit downgrades. When debt service costs can triple overnight, a borrower's creditworthiness shifts in months, not years, making traditional annual credit reviews obsolete.

This creates a fast-evolving credit landscape where static, annually updated models can no longer keep pace with shifting risks. Lenders now require dynamic, AI-powered tools that continuously adapt to new data and changing market conditions. This makes real-time underwriting essential for lenders competing to win quality borrowers while avoiding distressed credits.

This shift is unlocking opportunities across the entire credit value chain. Traditional banks are modernizing legacy infrastructure, embedded finance platforms are integrating credit decisions directly into commerce, and specialized AI companies are building the foundational infrastructure for next-generation underwriting. As regulatory frameworks evolve and data sources proliferate, AI-native approaches are quickly becoming essential for maintaining a competitive edge.

Using our proprietary signal model, which identifies patterns of early traction across product, people, and capital, we've selected the top Seed and Series A companies positioned to become category leaders.

Click any row in the table below to view detailed company profiles.

Companies shown were founded in 2022 or later, are at Seed or Series A stage, primarily U.S. focused, and operating in AI-native lending.

As AI-native lenders scale, they’re hitting a new infrastructure bottleneck: loan servicing and collections. While origination and underwriting have seen innovation, the post-origination stack—repayments, communications, portfolio ops—remain in manual, fragmented workflows. Without intelligent servicing, even the best models break down when loans hit friction. Collections lag, NPLs spike, and compliance risk grows. We’ve seen this pattern before: front-end automation creates pressure for smarter back-end systems. In lending, that means a new generation of infrastructure for dynamic repayment logic, borrower engagement, and real-time portfolio intelligence. The companies that execute this best will become essential to the AI-native lending stack.

If you're building in the AI-native lending space or have insights to share, would love to connect.

- Kiswana